Bitcoin’s Birthday Calls For Some Industry Updates

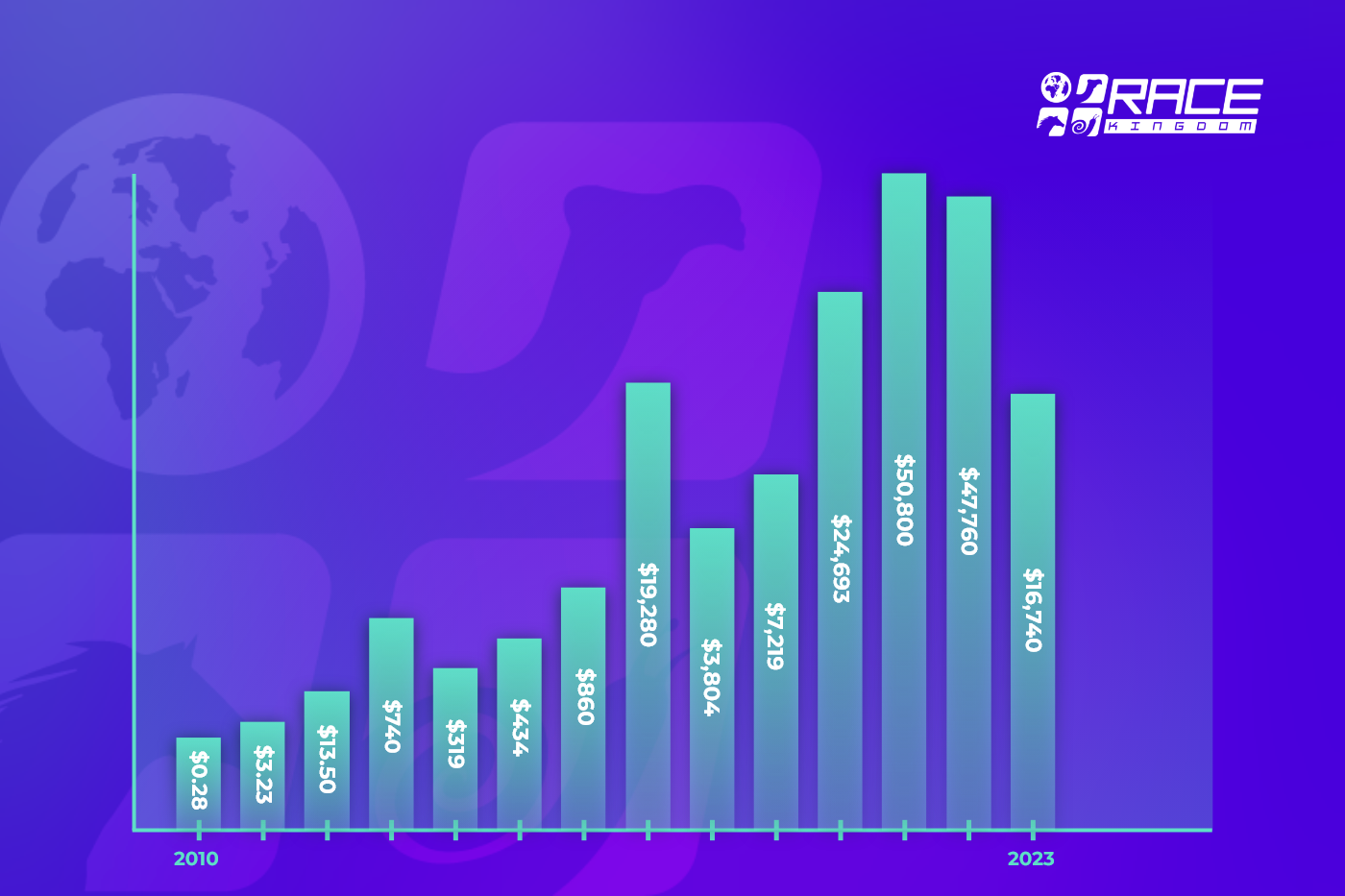

This week, Bitcoin officially turns 14 years old. When going down the road of important moments in Bitcoin’s history, one date strikes as most important. January 3 2009, the day bitcoin was officially launched after what’s known as the Genesis Block was mined.

Coming back to current times, 2022 has been a crucial year for the crypto industry, with many significant developments and milestones. As bitcoin continues to define the performance of the entire crypto market, here’s a short recap of what went down (pun intended) in the market this past year:

-

One of the most significant events was the widespread adoption of crypto by mainstream financial institutions. Major banks and investment firms began offering crypto-based products and services, and traditional payment companies like Visa and PayPal announced plans to support cryptocurrencies.

-

Another major trend was the continued growth of decentralised finance (DeFi). DeFi platforms saw tremendous growth in both users and the total value locked (TVL), with some platforms like Avalanche and Tron seeing their TVL surpass $1 billion.

-

The market cap of the entire crypto industry reached an all-time high in 2022, with the total market cap exceeding $2 trillion. Bitcoin, the most well-known cryptocurrency, also reached new all-time highs and saw its market dominance decrease as altcoins gained in popularity.

-

Regulatory clarity was another major theme of the year, with many governments and regulatory agencies issuing guidelines or outright regulations for the industry. This was seen as a positive development as it helped to legitimize the industry and protect consumers.

-

In October 2022 the European Council approved the Markets in Crypto-Assets (MiCA) Regulation, one of the first attempts globally at comprehensive regulation of cryptocurrency markets. The regulation extends to money laundering, consumer protection, the accountability of crypto companies and environmental impact.

As the world is grappling with dizzying inflation levels, Bitcoin seems arguably more viable, more relevant and more powerful than ever before. If you’re one of those that are still skeptical about the worth of Bitcoin though, here’s a story that might change your mind.

About 13 years ago, Laszlo Hanyecz, one of the early adopters of Bitcoin, purchased a pair of Papa Johns pizzas using 10,000 bitcoins. The purchase equated to roughly $41 dollars back in 2010, however, those 10,000 bitcoins would be valued at over $167 million at the current rate. So much for HODL huh?

And of course, bringing it around to $ATOZ. On July 15th 2022, one $50 dinner meal could’ve been purchased using 5000 $ATOZ. However the same 5000 $ATOZ in January 2023 would now be valued at $850. Therefore, the question remains: To indulge or to invest? Don’t let history repeat itself; choose to invest.